Expansion

2025 applications closed | Further dates TBC

At a glance

Grants

Funding additional financial counselling service delivery in areas of high disadvantage and high unmet demand for services.

- Target Region Expansion Grants – funding services in 20 identified regions of high disadvantage.

- Indigenous Organisation Expansion Grants – funding organisations that are at least 51% Indigenous owned or controlled to deliver services.

- State & Territory Expansion Grants – funding services within each state and territory.

- National Expansion Grants – funding nation-wide services.

Grant amounts: up to $156,000 p.a. for three years (or $195,000 for very remote SA4s)

2.5% annual CPI adjustment

Key dates

- Applications are now closed for 2025 Expansion Grants

- Notification of outcome 21 January 2026

- Grants commence 1 March 2026

- We hope to schedule a round in 2028, subject to ongoing funding.

How to apply

- When applications are open a link will appear on this page.

- Please read our Grants Guidelines

- You can use the Worksheet to prepare your responses

- You can also sign up for updates to receive updates and deadline reminders.

- NB Please submit your form before 5pm AET on the closing date.

See also

Grant Guidelines for this roundAbout FCIF

Our grants strategy

FCIF Grant probity policy

Help videos - how to apply

Application Worksheet

External Reviewers

What is unmet demand?

Webinars

Our CEO Elissa Freeman and Grants and Impact Manager Liz Gearing outlined the grant requirements and process, followed by a Q&A session, during webinars in August 2025.

You can watch the 28 August webinar here.

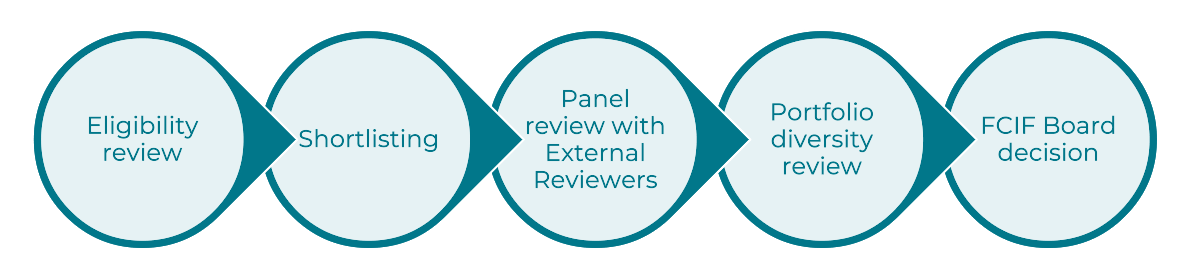

Our process

Expansion Grant FAQs

ABOUT THIS ROUND

What is the FCIF Expansion Grant Round?

The purpose of the 2025 Expansion Grant round is to reduce unmet demand by funding additional financial counselling service delivery in areas of high disadvantage and high unmet demand for services.

As outlined in our Funding Principles, industry funding is additional to ongoing government funding of financial counselling. The 2025 Expansion Round does not replace the ongoing role of government funding of financial counselling services.

What grants are available?

There are four types of Expansion Grants in the 2025 Expansion Round:

- Target Region Expansion Grants – funding additional financial counselling services in 20 identified Statistical Area 4 (SA4) regions of high disadvantage (the regions are specified in our Guidelines)

- Indigenous Organisation Expansion Grants – funding organisations that are at least 51% Indigenous owned or controlled to deliver additional financial counselling services

- State & Territory Expansion Grants – funding additional financial counselling services within each state and territory.

- National Expansion Grants – funding organisations that deliver services nation-wide to deliver additional financial counselling services

How much funding is available overall?

Approximately $22.79 million in total will be awarded in the 2025 Expansion Grant round.

How long is the funding period?

Grants will be awarded for a three-year period.

What costs will be funded?

Expansion Grants must be used to:

- provide free financial counselling to help people unable to pay their bills, or at imminent risk of not being able to do so, to address their financial problems through the provision of information, advocacy and/or negotiation

- provide free financial capability services to help people to build longer-term financial skills, knowledge and capabilities

FCIF will fund the following:

Salaries (or part thereof) for:- Financial Counsellors

- Financial Capability Workers

- Trainees in either of the above roles

- Professional membership fees

- Professional training and development

- Professional supervision

- Rent, utilities, telecommunications, insurance expenses

Administrative expenditure related to FCIF-funded grant activities, such as:

- Interpreting or translating services

- Vehicle lease expenses

- Domestic transport expenses

- Assets up to $10,000 that can reasonably be attributed to service delivery

- Technology expenses

- Client intake and triage costs

Other expenditure directly related to FCIF-funded grant activities

Please note that FCIF-funded employees must be paid in accordance with the relevant Industrial Award and FCIF-funded financial counsellors must maintain membership of a financial counselling professional association.

What costs will NOT be funded?

Expansion Grants must not be used to undertake:

- Commercial or profit-making activities

- Activities that promote, support or oppose a political party, candidate or elected official

- Activities funded by other sources

- Activities not related to financial counselling or financial capability

- Financial capability services where the organisation does not also provide financial counselling services

FCIF will not fund the following:

- Cash payments, or other financial benefits, to clients

- Costs not related to the FCIF-funded activities

- Retrospective costs

- Litigation costs

- Overseas travel

- Funding for staff or operational costs beyond the grant term

ELIGIBILITY

Is my organisation eligible for a grant?

Yes, if your organisation is an Australian registered business.

No, if you or your organisation are:

- Private individuals (including sole traders)

- Government entities

Can we apply as part of a consortium or partnership?

Yes. You must nominate a lead applicant who will enter into the Grant Agreement and is solely accountable to FCIF for the delivery of the grant activities.

Can you give advice about whether our service meets the criteria for this round?

No. Probity and equity of access are critical across all our processes, as outlined on our 2025-2028 Strategy page. Our Grant Probity Policy specify that all applicants must have equal access to information, so rather than answer individual queries we publish generalised answers (i.e., not specific to your organisation or application) on our website, where they can be viewed by all.

My organisation has a grant from another funding source to provide financial counselling services until 31 December 2026. Can I apply for an Expansion Grant?

Yes, however you will need to ensure that you are not seeking FCIF funding for activities that are funded by another source, as this contravenes our Grant Guidelines and will void your application.

Your application should clearly explain how you will ensure that you are not seeking funding for activities that are already funded.

You may elect to terminate your existing grant if you are successful in the 2025 Expansion Round. Alternatively, you may limit your application to the activities from 1 January 2027, in which case you must ensure that your grant activities, grant outcomes and budget explicitly exclude activities prior to this date. Please note that FCIF’s 2025 Expansion Grants commence on 1 March 2026 and have a fixed term of three years terminating on 28 February 2029.

It is your responsibility to ensure your application is eligible.

All applications will be assessed in the same process, using the same criteria, and in accordance with our funding principles.

Will organisations that are allocated an Expansion grant also be able to apply for next year's Innovation and Workforce grants?

Yes. Successful applicants for this grant round, if eligible, can apply for subsequent grant rounds.

Can I apply for multiple grants in this round?

No. Eligible organisations may submit one application only.

An eligible organisation that operates across multiple state/territory jurisdictions under a single ABN may be eligible to submit multiple applications, subject to FCIF’s prior approval.

This approach maximises the diversity of services funded by FCIF, as well as reducing duplication of effort for applicants.

I'm eligible for more than one grant type. What if I don't select the best one?

FCIF may, at its discretion, award a grant type different to the grant type sought in an application

Your application will always be considered for the grant type you choose.

However, we may also consider your application for an additional grant type if we identify that it would be competitive for that grant type.

NEW - What is an Indigenous Organisation?

Indigenous Organisations are organisations that are at least 51% Indigenous owned or at least 51% Indigenous controlled (Board members or equivalent). This definition aligns with the Department of Social Services’ definition of Indigenous Organisations.

Added 1 September 2025

NEW - Can I apply if I am not currently providing financial counselling services?

Yes, you are eligible to apply. However, organisations not currently providing financial counselling services are less likely to meet our assessment criteria. We acknowledge, however, that in rare cases there may be a compelling reason why an organisation not currently providing financial counselling services is able to meet our assessment criteria. To accommodate these exceptional circumstances, grants are open to such organisations. We strongly encourage you to apply only if you have a compelling case.

Added 1 September 2025

NEW - My organisation only provides financial capability services, are we eligible to apply?

FCIF will not fund activities solely related to financial capability where the organisation does not also provide financial counselling services.

Added 1 September 2025

UNMET DEMAND

NEW - What is unmet demand?

A good way to think about unmet demand is this: It’s the people knocking at your “door” who can’t get in, or are waiting too long to get in.

See the video on this page to explain unmet demand.

Added 1 September 2025

NEW - How do we demonstrate unmet demand?

The application process allows for you to tell us your story about how your organisation is experiencing unmet demand for financial counselling services in the grant’s service delivery area. You can include any factors that you think are relevant to your organisation’s experience of unmet demand. We have asked that you be as specific as possible. You should not assume that we know about demand for your service or your ability to meet that demand – you need to explain this in your application.

The application process also asks you to provide data on your unmet demand. If you don’t collect the data, you are able to indicate this.

If you are successful in this grant round you will be required to report on your unmet demand as part of your regular reports, in a form to be specified by FCIF.

NEW - Can you provide guidance about how my organisation should explain our unmet demand?

No, FCIF can only provide general information and advice on completing your application.

Added 1 September 2025

NEW - I have evidence of unmet need, not unmet demand in my service area. Will this meet your requirements?

No, evidence of unmet need will not meet our requirements. The assessment criteria relate to unmet demand.

Added 1 September 2025

APPLYING

Can I email or mail my application?

No. All applications must be submitted via FCIF’s applicant portal and in accordance with our Guidelines. You will need to register for an account or log in if you have an existing account.

What if there is a conflict of interest?

As part of your application, you will be asked to declare any actual, perceived or potential conflicts of interest or that, to the best of your knowledge, there is no conflict of interest.

If you later identify an actual, perceived or potential conflict of interest, you must immediately inform FCIF in writing by email to grants@fcif.org.au.

Will application questions be published in advance?

No. All questions will be available for all applicants on the opening day. This should give you sufficient time to complete your responses.

Can someone from FCIF help me with my application?

FCIF staff can only provide general information and advice on completing your application. To maintain fairness and integrity of the application process, applicants cannot be offered individual support or help with their application. Please use the materials on this page for help in setting up an account and completing your application.

Should you experience issues logging in to Blackbaud GrantsConnect, please use their login help documentation. If you are unable to resolve your issues, please contact grants@fcif.org.au.

What am I expected to provide with my application?

To complete the application, you will need to upload your organisation's most recent audited Financial Report (or equivalent).

You can view our worksheet to see all questions and information required.

Should I include GST in my application?

No. If your application is successful and your organisation ABN is registered for GST, you’ll be paid GST on top of the approved grant amount. If your organisation ABN is not registered for GST, you will only be paid the approved grant amount.

Why can't FCIF use the information in my recent DSS application?

FCIF and the Department of Social Services (DSS) are separate funding bodies, each with its own eligibility criteria, assessment process, and application requirements. For privacy and legal reasons, information you provide to DSS cannot be shared with FCIF.

Why are your questions different to the questions in the recent DSS round?

Our application form includes questions tailored to evaluate your application against FCIF’s assessment criteria. These criteria are designed to reflect FCIF’s core purpose and Grants Strategy, which differ from those of other funding bodies, such as DSS.

What if I miss the application deadline?

Late applications will not be accepted unless an applicant has experienced exceptional circumstances that prevent the submission of the application. Broadly, exceptional circumstances are events characterised by one or more of the following:

• reasonably unforeseeable;

• beyond the applicant’s control; and

• unable to be managed or resolved within the application period.

Exceptional circumstances will be considered on their merits and in accordance with probity principles. Requests to submit a late application must be submitted by email to grants@fcif.org.au.

What happens if I made a mistake in my application?

Once your application form has been submitted it cannot be edited. However, if you have made a mistake that you feel is material to your application and you would like to change your answer, please email grants@fcif.org.au and request your application be published for resubmission.

NEW - Can the grant be used to employ trainees?

Yes, FCIF will fund salaries (or part thereof) for trainee Financial Counsellors and trainee Financial Capability Workers.

Added 1 September 2025

NEW - Do services have to be provided across the entire SA4 region(s) we nominate?

No, there is no requirement to provide your service across an entire SA4 region. Nor is there a requirement to provide your services state-wide for a State/Territory Expansion Grant (although you may choose to).

Added 1 September 2025

NEW - I am currently funded to provide financial counselling services in an SA4, but we still have unmet demand in the SA4 area. Am I eligible to apply?

Yes, you can seek a grant to provide additional service delivery to address the unmet demand in the SA4 area. You should ensure that your application (including the budget and outcomes) only includes the FCIF-funded grant activities and no activities, outcomes or budget expenses that are already funded by another source.

Added 1 September 2025

NEW - Do we have to apply for the full grant amount?

No, you should seek funding that reflects your situation. For example, if your unmet demand could be met by employing an additional 0.4FTE Financial Counseller then you should apply for that.

Added 1 September 2025

NEW - What service delivery area is required for a State/Territory Expansion Grant?

If you are applying for a State/Territory Expansion Grant you will be asked to nominate your service delivery area in your application. You can either nominate the entire state/territory, or you can select one or more SA4s in which you will deliver your services. Please note that State/Territory Expansion Grants do not have to be delivered across the whole state/territory.

Added 8 September 2025

WHAT'S NEXT?

How are applications assessed?

Applications will be evaluated against the following criteria:

- Unmet demand: Evidence of unmet demand for financial counselling services in the nominated service delivery area (30%)

- Impact: The extent to which the grant activities are expected to reduce unmet demand (30%)

- Efficiency & capability: The applicant’s capability to deliver the grant activities and the extent to which the grant activities demonstrate value for money (40%)

When will I know the outcome of my application?

Successful applicants will be notified by 21 January 2026.

Will you provide feedback?

General feedback will be published on the FCIF website at the conclusion of the assessment process. Individual feedback to unsuccessful applicants will not be provided.

What are my obligations if a grant is awarded?

Successful applicants must:

• Enter into a legally binding Grant Agreement with FCIF outlining grant activities, payment milestones, reporting requirements and funding terms and conditions.

• Submit six monthly progress reports based on the grant activities and outcomes, including data on levels of unmet demand and data reporting on services delivered under the grant, in a standard format as defined by FCIF. Please see our Guidelines for a list of the service data that we will require grantees to submit in their progress reporting.

• Complete a final report, using FCIF’s template, detailing grant outcomes, learnings and impact. Impact reporting will be based on our impact measures.

• Provide a financial acquittal. Unspent funds must be returned to FCIF.

What reporting will be required?

Grantees must:

• Submit six monthly progress reports based on the grant activities and outcomes, including data on levels of unmet demand and data reporting on services delivered under the grant, in a standard format as defined by FCIF. Please see our guidelines for a list of the service data that we will require grantees to submit in the progress reporting.

• Complete a final report, using FCIF’s template, detailing grant outcomes, learnings and impact. Impact reporting will be based on our impact measures.

• Provide a financial acquittal. Unspent funds must be returned to FCIF.

When is the next Expansion Round?

We hope to schedule a round in three years, subject to ongoing funding. We are working hard to make this happen, and the data generated in this round will help us to communicate the efficacy of this funding model.

Sign up to receive alerts when we announce dates and open grant rounds.

Do you still have questions? Email grants@fcif.org.au. We'll respond and update this page as appropriate.

.gif?width=1000&name=with%20pics%20no%20voiceover%20-%20Web%20sized%20unbranded%20unmet%20v%20unmet%20need%20(3).gif)